Launching Responsible Leaders

Welcome to Claremont McKenna Admission

Among the nation’s top liberal arts colleges, Claremont McKenna College is dedicated to preparing our students for roles of responsible leadership in business, government and the professions. Our collaborative community fosters an environment where students can explore and deepen their academic interests, while working closely with their professors and classmates on research in our institutes, centers, and labs. Through our Open Academy, students learn to speak freely with respect, listen actively to a range of viewpoints, and engage in constructive dialogue.

Expanding student opportunity is one of our core priorities. We remove financial barriers through our need-blind and meet-all-need commitments. We open doors through well-funded and transformative career experiences. We have proven outcomes, and are ranked #1 by Forbes in liberal arts for value and return on investment.

We invite you to learn more about Claremont McKenna where you can create lifelong friendships, prepare to navigate uncertainty with resilience, and create your own opportunities to a fulfilling future.

Exploration, Choice & Discovery

At Claremont McKenna College, our diverse intellectual and social community is fueled by a greater ambition—to put collaborative and responsible leadership to work for everyone.

Here, you will ask big questions, solve complex problems, engage in constructive dialogue reimagine research opportunities, nourish individual passions, and develop lifelong friendships with peers, faculty, staff, and alumni—forever bonding you to our close-knit residential oasis in Southern California.

Does it sound like CMC could be home? Learn more about our holistic admission review and meet-all-need financial and merit aid resources.

First-Year Admission Requirements

Transfer Admission Requirements

Intellectual Rigor & Critical Inquiry

Your intellectual curiosity knows no limits – and neither does the CMC curriculum.

We combine the intimate liberal arts college experience with the opportunities of a research university – small, discussion-based classes; advanced research and learning through 11 graduate-level institutes and centers; internationally recognized guest speakers visiting campus four nights weekly through our signature Athenaeum program; our award-winning Open Academy, developing a critical response to the educational imperative of our time: overcoming what divides us to solve the world’s most challenging problems; and our new Kravis Department of Integrated Sciences, which is unique in its approach to organize science education around socio-scientific grand challenges and leveraging computation as a powerful vehicle for discovery and systemic solutions.

Interdisciplinary Majors and Programs

CMC Commitments to Freedom of Expression, Viewpoint Diversity, and Constructive Dialogue

The Presidential Initiative on Anti-Racism and the Black Experience in America

Real World Experiences, Internships & Outcomes

When intellectual rigor and personal insight are blended with expert guidance and real-world resources, extraordinary opportunities ensue.

Looking across the campus through the “eyes of a student,” the Soll Center for Student Opportunity ensures students recognize, cultivate and translate their interests and strengths into meaningful and exciting real-world experiences, ranging from internships and fellowships, to graduate and professional programs, to employment and career enrichment.

Support is provided in three distinct areas: individualized coaching and support; early real-world career experiences; and unparalleled access to, and support from, a caring community of successful alumni, parents, faculty, and staff.

Claremont McKenna has been recognized by Forbes, as the #1 liberal arts college for return on investment and value. Princeton Review ranks the Soll Center for Student Opportunity #4 nationally.

The Soll Center for Student Opportunity

Community, Purpose & Play

As a residential community, CMC fosters a vibrant living and learning environment, encouraging students to develop and participate in a broad range of opportunities that facilitate their holistic growth and understanding of self and others.

CMC’s distinctive social warmth infuses itself in every aspect of student life – from our daily Athenaeum Tea, to the spirit of our varsity athletic teams, our friendly dining hall to a communal culture of academics and student activities that emphasizes shared purpose, playfulness, and the pure joy of learning.

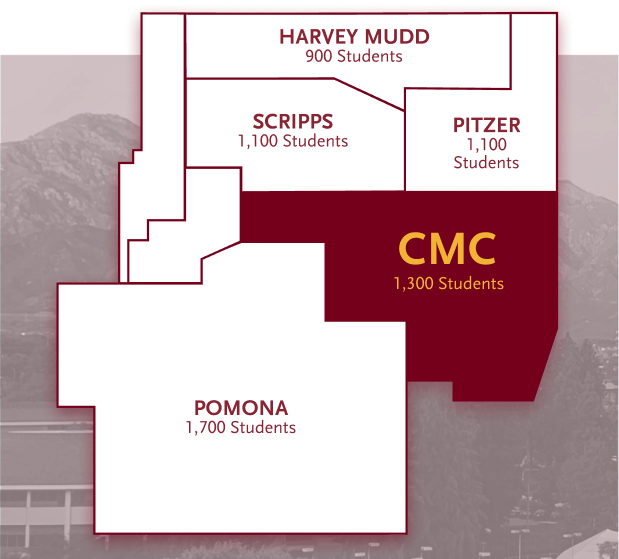

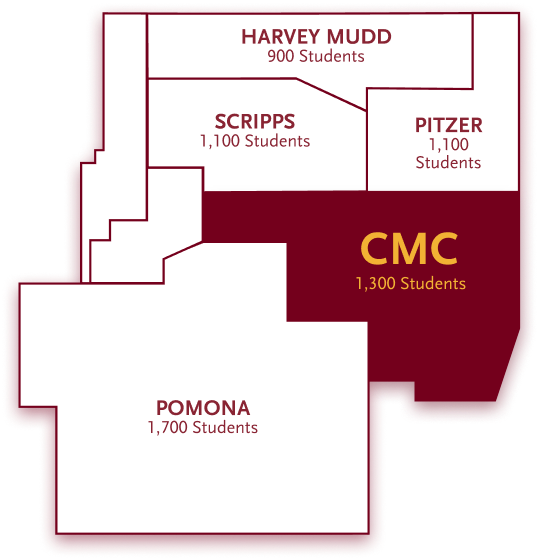

As a proud member of The Claremont Colleges, Claremont McKenna offers the best of both worlds – a small, tight-knit campus with “big school” social benefits, with 9,000 students within one square mile.

CMCers in Action

Sunny Southern California

Located at the foothills of the San Gabriel Mountains, Claremont is in the sweet spot of Southern California. Go for a hike, surf in the ocean, snowboard in the mountains, visit a museum in the city, or enjoy your favorite band at a music festival.

The Claremont Colleges

9,000 students in one square mile, The Claremont Colleges include five undergraduate liberal arts colleges and two graduate institutions uniquely enabling students to attend a small, tightly-focused college, while still enjoying the benefits of a bigger, unified campus.

- More than 2,200 courses offered for cross-enrollment

- Nearly 20 dining options, including 7 dining halls

- 150+ clubs and organizations

- 99% of CMC students take a class at another Claremont College